|

| FG Launches N50 Electronic Levy on Transactions Over N10,000 via Fintech Platforms like Opay, Moniepoint, and Others |

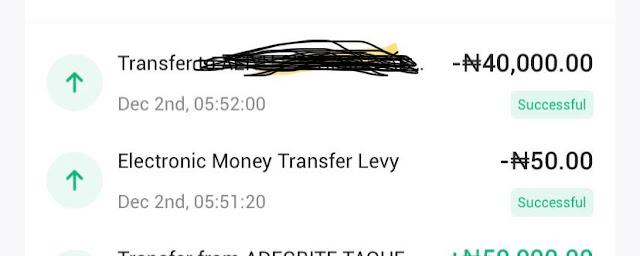

The Federal Government of Nigeria has officially commenced the N50 Electronic Money Transfer Levy (EMTL) on transactions of N10,000 or more conducted via various fintech platforms such as Opay, Moniepoint, Kuda, and others. This new levy, which is part of the Finance Act 2020, aims to collect a one-time fee of N50 on any electronic money transfer or receipt amounting to N10,000 or more.

What is the Electronic Money Transfer Levy (EMTL)?

The EMTL, introduced under Nigeria's Finance Act 2020, imposes a single levy of N50 on the recipient of electronic transactions or transfers that exceed N10,000. This levy was initially set to take effect on September 9, 2024, as part of the government's ongoing efforts to increase tax collection and regulate digital payments.

However, the implementation of this levy has sparked significant controversy, with various groups, including the National Association of Nigerian Students (NANS), expressing strong opposition to the new tax. NANS and other organizations have called on the government to reconsider the levy, arguing that it places an additional financial burden on citizens.

How Fintech Platforms Like Opay and Moniepoint Are Responding

In response to the implementation of the EMTL, fintech companies have been issuing notices to their customers. One of the leading platforms, Opay, informed its users earlier in September that the new levy is being enforced by the Federal Inland Revenue Service (FIRS) and emphasized that Opay itself does not benefit from the levy.

In a message to users, Opay stated:

"Please note that Opay does not profit from this charge. The N50 fee is entirely directed by the Federal Government through the FIRS."

Similarly, Moniepoint also sent a notification to its users, clarifying that the N50 levy will apply to inflows of N10,000 and above. The platform further clarified that the levy would be collected and remitted to the FIRS.

Moniepoint's message read:

"Dear Customer, you will be charged a stamp duty of N50 on all transactions of N10,000 and above. Moniepoint collects and remits this levy to FIRS on your behalf."

The EMTL Deduction Officially Begins

As of December 1, 2024, the implementation of the N50 EMTL deduction has officially begun. Both Opay and Moniepoint have confirmed that they are now deducting the levy from eligible transactions. Other fintech platforms are expected to follow suit, with the federal government closely monitoring the process.

While the levy is set at N50, it will only apply to electronic transactions above N10,000, making it a targeted form of tax collection. This new measure is part of Nigeria's broader push to regulate the growing fintech industry and improve tax compliance within the digital economy.

Public Reaction and Future Implications

The introduction of the N50 EMTL has generated mixed reactions. While some Nigerians view the levy as a necessary step to improve government revenue, others have raised concerns about its potential impact on low-income individuals who rely heavily on digital platforms for their daily transactions.

In light of the opposition, it remains to be seen whether the government will make any adjustments to the policy or if further protests will influence future amendments to the Finance Act.

In My Conclusion

As the implementation of the N50 Electronic Money Transfer Levy progresses, Nigerian fintech users should be aware of the new deductions on their transactions. It is essential for both individuals and businesses to stay informed about how these changes will affect their digital financial activities. While some see the levy as a step toward more comprehensive digital financial regulation, others question its fairness and effectiveness in the long run.

HOTGISTLOADED

_(cropped).jpg)

.png)

0 Comments